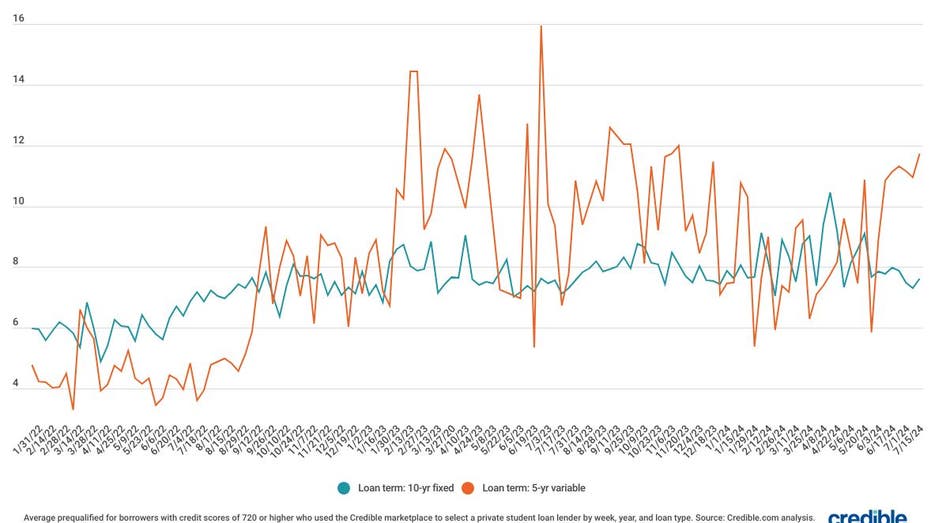

During the week of July 15, 2024, average rates for private student loans saw an increase for borrowers with credit scores of 720 or above using the Credible marketplace. Rates for 10-year fixed-rate loans and 5-year variable-rate loans both rose:

- 10-year fixed-rate loans: Increased to 7.62% from 7.29%, a rise of 0.33 percentage points.

- 5-year variable-rate loans: Jumped to 11.74% from 10.94%, a spike of 0.80 percentage points.

While private student loans can cover educational and living expenses not addressed by federal loans, it’s wise to explore federal options first due to their benefits, such as income-driven repayment plans. Private loans from banks, credit unions, and online lenders come with varying interest rates and terms based on individual financial circumstances and credit histories.

SPONSORED

For borrowers who utilized the Credible marketplace during the week of July 15, here’s a summary of private student loan rates:

Who Determines Federal and Private Interest Rates? Federal student loan rates are set annually by Congress, influenced by the loan type, dependency status, and academic year. In contrast, private student loan rates, which can be fixed or variable, are influenced by credit scores, loan terms, and other factors. Generally, better credit scores lead to lower interest rates.

Understanding Student Loan Interest Interest rates are percentages added periodically to the loan balance, representing the cost of borrowing. Payments typically cover interest first before reducing the principal. Lower interest rates can save money and reduce the repayment period.

Fixed vs. Variable-Rate Loans

- Fixed-Rate Loans: The payment amount remains constant throughout the loan term.

- Variable-Rate Loans: Payments can fluctuate based on changes in interest rates.

Using Credible for Rate Comparison Credible simplifies comparing private student loan rates.

Calculating Potential Savings A student loan interest calculator helps estimate monthly payments, total interest, and overall repayment costs.

About Credible Credible is a multi-lender marketplace designed to help consumers find financial products that best suit their needs. With integrations with top lenders and credit bureaus, Credible allows users to compare personalized loan options securely and without impacting their credit score. The platform is highly rated, with over 7,500 positive Trustpilot reviews and a TrustScore of 4.8/5.